3 September 2025

If you’re considering a bond, one of the first questions is, do you want one with a short or long duration. A short duration means the time to maturity is generally less than 5 years, which can mean that there’s less time to wait before re-investing, or taking the funds out. This can also mean a greater degree of certainty over the expected returns.

| Bond | High yield bond | Securitised credit | |

Coupon rate |

Fixed rate generally |

Fixed rate generally |

Floating rate in general, offers a margin above a reference rate |

Cash flow to pay coupons |

Generated from issuer’s underlying business activity |

Generated from issuer’s underlying business activity |

Generated from underlying collateral (e.g., the repayments on mortgages) |

Maturity |

Fixed usually, with all the principal received on the maturity date |

Fixed usually. with all the principal received on the maturity date |

Depends on collateral characteristics e.g., principal prepayment, default rates and structural features |

Tranche |

All holders of the bond receive payments and suffer losses equally |

All holders of the bond receive payments and suffer losses equally |

Note holders receive payments and suffer losses depending on how senior their note is |

Credit rating |

Depends on the ability of the issuer to repay the bond |

Depends on the ability of the issuer to repay the bond. Non-investment grade bonds are rated below BBB- |

Depends on the tranche’s probability of suffering losses subject to the underlying collateral and structure of the securities |

|

Coupon rate |

Coupon rate |

|

|---|---|---|

| Bond |

Fixed rate generally |

Fixed rate generally |

| High yield bond |

Fixed rate generally |

Fixed rate generally |

| Securitised credit |

Floating rate in general, offers a margin above a reference rate |

Floating rate in general, offers a margin above a reference rate |

|

Cash flow to pay coupons |

Cash flow to pay coupons |

|

| Bond |

Generated from issuer’s underlying business activity |

Generated from issuer’s underlying business activity |

| High yield bond |

Generated from issuer’s underlying business activity |

Generated from issuer’s underlying business activity |

| Securitised credit |

Generated from underlying collateral (e.g., the repayments on mortgages) |

Generated from underlying collateral (e.g., the repayments on mortgages) |

|

Maturity |

Maturity |

|

| Bond |

Fixed usually, with all the principal received on the maturity date |

Fixed usually, with all the principal received on the maturity date |

| High yield bond |

Fixed usually. with all the principal received on the maturity date |

Fixed usually. with all the principal received on the maturity date |

| Securitised credit |

Depends on collateral characteristics e.g., principal prepayment, default rates and structural features |

Depends on collateral characteristics e.g., principal prepayment, default rates and structural features |

|

Tranche |

Tranche |

|

| Bond |

All holders of the bond receive payments and suffer losses equally |

All holders of the bond receive payments and suffer losses equally |

| High yield bond |

All holders of the bond receive payments and suffer losses equally |

All holders of the bond receive payments and suffer losses equally |

| Securitised credit |

Note holders receive payments and suffer losses depending on how senior their note is |

Note holders receive payments and suffer losses depending on how senior their note is |

|

Credit rating |

Credit rating |

|

| Bond |

Depends on the ability of the issuer to repay the bond |

Depends on the ability of the issuer to repay the bond |

| High yield bond |

Depends on the ability of the issuer to repay the bond. Non-investment grade bonds are rated below BBB- |

Depends on the ability of the issuer to repay the bond. Non-investment grade bonds are rated below BBB- |

| Securitised credit |

Depends on the tranche’s probability of suffering losses subject to the underlying collateral and structure of the securities |

Depends on the tranche’s probability of suffering losses subject to the underlying collateral and structure of the securities |

When you buy a bond, you know what the fixed interest rate will be paid on it.

The returns of a bond are composed of coupon income and price changes. A key measure of bond markets is the bond ‘yield’, which is the amount an investor will get from it. Yields from bonds are inversely related to bond prices. When yields rise, bond prices fall assuming all factors unchanged. Factors driving yields include changes in credit ratings and interest rates.

An illustrative example

However, what happens if the interest rate falls?

In the above example, if the interest rates were cut to 2%, these bonds would look more attractive, as they are paying above market rate. If they are more attractive to the markets, the price of the bond would rise.

So, a cut in interest rates is likely to increase the price of bonds. A rise in interest rates is likely to reduce the price of bonds.

A yield curve is a line that plots yields (that is, the annual rate of return until maturity) of bonds with equal credit ratings but different maturity dates. There are generally three types of yield curve;

1. Upward Sloping

When an economy is growing, we should see an upward-sloping yield curve. Bonds with a longer-term maturity date typically offer higher yields to compensate for the additional potential volatility, for example with regards to interest rates.

2. Downward (inverted) sloping

A downward or inverted yield curve likely indicates an economic downturn, as investors expect lower interest rates to be used to stimulate economic growth.

3. Flat

A transition between these two scenarios could result in a flat yield curve.

The interest rates set by central banks are a key driver of the cost of borrowing, for governments and businesses. When inflation falls, central banks tend to decrease interest rates to stimulate economic activity and encourage increased spending. In such an environment, bond yields tend to decrease.

The situation will reverse in a higher inflation environment where central banks can raise interest rates to slow down the economy and reduce inflation.

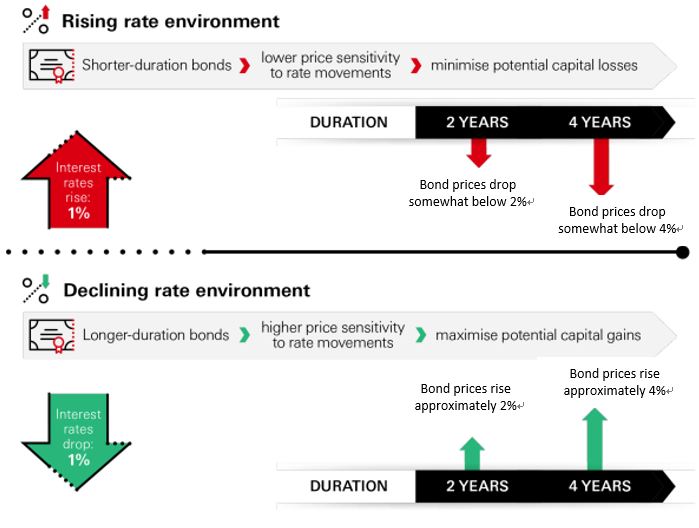

Duration, expressed in the unit of years, measures the sensitivity of bond prices to interest rate movements. The longer the duration, the more sensitive the prices to interest rate changes. Shorter-term bonds (typically up to 5 years) are generally more resilient to interest rate fluctuations than longer-term bonds.

If interest rates rise by 1%, bond prices will normally drop by around 2% and 4% for a bond with a 2-year and 4-year duration respectively. Conversely, if interest rates fall by 1%, a bond with a 2-year duration could experience a gain in value of around 2%, while the price of a bond with a duration of 4 years could increase by around 4%. This is based on previous experience in the markets and analyst views of future changes.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal. This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.