29 Jan 2024

Willem Sels

Global Chief Investment Officer, HSBC Global Private Banking and Wealth

With interest rates expected to decline amid falling inflation and slowing growth, the appeal of high cash rates should be re-evaluated. Historically, multi-asset portfolios delivered three times the return on cash on average in both low and high interest rate periods. We highlight three reasons why it is important to deploy cash today.

Broad markets indeed outperformed cash in 2023. Cash return of around 5% may appear attractive when compared to the historical cash returns in the period between the Global Financial Crisis and the COVID recession. But the real opportunity cost of cash stems from its relative performance compared to other assets, and these have been substantially higher in 2023. Moreover, with the consumer prices rising around 3.5% in 2023, these nominal returns translate to only 1.5% real return for cash.

As cash rates are the fundamental building block for all asset class returns, an increase in cash rates lifts the total long-term expected returns across all markets: stocks, bonds, and alternatives. Furthermore, the risk premia for government bonds and equity markets increased in 2023, boosting their potential for outperformance in the future. It is important that investors should not evaluate investment opportunities (such as cash) in isolation but against alternative opportunities, and to consider the prospective real returns rather than nominal only.

Another important observation is that rate hikes are already behind us. At the time of writing, forecasters, markets, and central bankers all are expecting no further interest rate increases from their current levels. Money market futures are implying approximately six 0.25% cuts by January 2025 in the US and Eurozone. We expect interest rate cuts to commence from the middle of 2024. This means that the cumulative return from holding cash over any relevant time horizon is unlikely to match the current level of annualised yields.

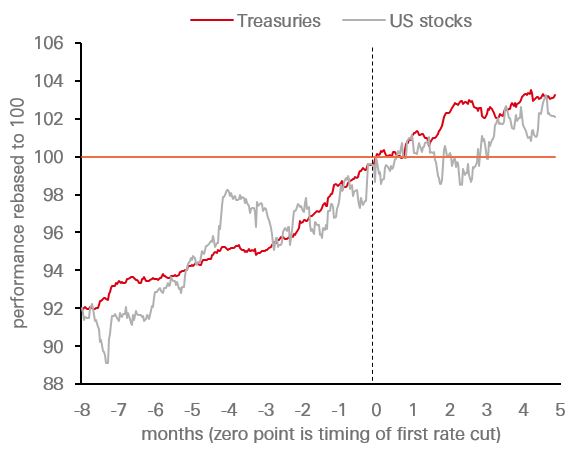

Finally, let’s look at all the historical scenarios relating to the initial interest rate cuts following a hiking cycle. As Chart 3 shows, both the stocks and bond markets have delivered 8-9% total return in the eight months ahead of the first rate cut on average, significantly outperforming cash holdings. Markets are forward looking. They tend to anticipate rate cuts and rally ahead of them, especially for bonds.

In summary, we believe stock and bond markets are going to substantially outperform cash in the year leading up to initial rate cuts, as they have in the past cycles. Diversified multi-asset portfolios, especially with access to alternatives (e.g., hedge funds, private equity and commodities), can help maximise returns while mitigating uncertainties.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal. This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.