24 March 2023

Among the retired women involved in a survey carried out by YouGov for HSBC[@yougov-plc-for-hsbc], over 90% said they need up to £30,000 (around USD38,500) a year to fund their lifestyle. However, for many women, this amount is difficult to obtain. Another 29% stated that they don’t have enough money to make ends meet. A further 10% said their retirement savings aren’t enough to cover household bills, while 30% of respondents can’t afford to run a car.

Although these numbers may vary from country to country, it does serve as a wake-up call to all women regardless of where you live. Globally, the gender pay gap is improving, but women generally earn less than men throughout their careers, which limits the amount they can save for retirement. For example, women are more likely to take career breaks or reduce their working hours to look after children or elderly parents, thereby affecting their pension contributions and retirement income.

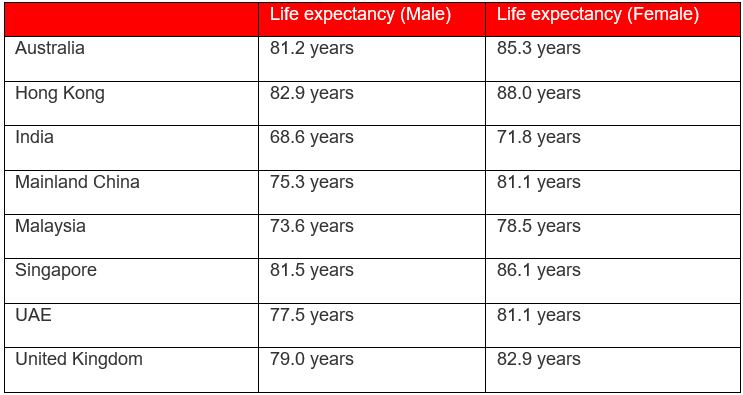

Life expectancy has also increased, with women generally living some four to eight years longer than men, due partially to more male smoking and drinking alcohol, physical stress with simultaneous aversions to medical treatment and health precautions, as well as genetic reasons[@]. Therefore, any retirement income may need to stretch further over a longer period of time for women. This fact shouldn’t be under-estimated. The earlier you start saving for your retirement, the more likely you are to:

Taking action feels good. Here are some positive changes you can make today for a more comfortable retirement.

If you can, now is the time to add as much as possible to your workplace pension or your retirement savings and make the most of tax relief from the government. Some employers offer to match your contributions up to a certain limit – if yours does, try to make the most of it.

If you’ve taken a career break, you may have gaps in your retirement savings. It may be possible to make voluntary contributions to make up for these.

Take a look at your budget to see where you could potentially free up money. The more you save now, the more you’ll have to retire with.

Investing is an alternative way to save for your future, and could potentially provide higher long-term growth than leaving your money in a savings account, and help you combat inflation. The key difference is there are no guarantees as the value of investments can go down, as well as up, and you may not get back what you invest.

If you’re married, in a civil partnership or in a stable relationship with shared assets, you may want to look at both your pensions and savings together. Try to work out the cost of living together when you’re no longer working.

If you’re near retirement age and are concerned you won’t have enough money, think about whether you can delay when you finish work. If that’s an option, let your pension provider know as it may make sense to change the ways in which your pension is invested.

Switching to reduced working hours or ‘semi-retirement’ can also give you more financial security, as well as a better work-life balance.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal. This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.