30 June 2025

What can investors expect from markets in the second half of 2025? So far this year, fading US exceptionalism has been a defining feature of the investment landscape. For years, US leadership has been characterised by relatively strong GDP growth, outsized stock market returns, and the strength of the dollar. For markets, it has been dollar weakness in particular, that has influenced returns in the first half – and that looks set to continue.

The H1 headline is that US stocks have underperformed the rest of the world. A weaker dollar, cooling US growth, and higher levels of uncertainty – driven by unpredictable policy – have driven investors to look further afield for superior risk-adjusted returns. That’s seen a switch in equity leadership to Europe, the Far East, and emerging markets (EM), and value outperforming growth. Dollar weakness has created new policy space for EM central banks, with proactive rate cuts – in contrast to a reactive Fed – oxygenating EM bonds and stocks, which have long been under-owned in the era of US exceptionalism. Meanwhile, stronger EM currencies have boosted the appeal of local bonds to global investors.

Meanwhile, a regime of “deficits forever” and a cautious Fed have kept 10-year Treasury yields high in H1, limiting returns and impairing their traditional role in protecting portfolios. Selective credits, real assets and liquid diversifiers like hedge funds and infrastructure have been positive. And the price of gold – a natural haven in uncertainty – has soared.

As pressure builds on risk-adjusted returns, it is important that investors are ready to adapt. Staying nimble and embracing tactical asset allocations will be key to navigating inherently unsettled markets.

Asian stock markets were volatile in the first six months of 2025 – but there were some stellar returns. The MSCI Asia ex-Japan index is up 13% year to date in USD terms, eclipsing US gains. Fading US exceptionalism (especially a weaker dollar) is a catalyst for the rest of the world assets.

A solid performance in China (+19%, USD) was helped by tech sector strength – including advances at AI firm DeepSeek – progress on a US trade deal, and an ongoing policy put.

Meanwhile, South Korea (+32%) set the pace on post-election expectations of fresh policy stimulus and corporate governance reforms, as well as an AI-demand led semiconductor sector recovery. Hong Kong (+18%) was buoyed by lower local rates and a pick-up in trading activity and new listings. And Taiwan posted a 5% gain in H1 but saw a strong pick-up in Q2 largely attributable to FX effects. Overall, some equity analysts continue to see Asia offering broad sector diversification and quality-growth opportunities at reasonable valuations – but selectivity is key.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg. See page 8 for details of asset class indices. Data as at 7.30am UK time 27 June 2025.

European stocks have outperformed most global markets in 2025. It follows 15 years of underperformance versus the US – leaving it at a deep valuation discount coming into 2025. The main catalyst was fading US exceptionalism and ultra-high policy uncertainty, which delivered a wake-up call for both European policymakers and investors. Germany’s decision to open the fiscal taps to fund spending on defence and industry was key and raises the prospect of renewed growth across the bloc. A backdrop of falling inflation and ECB policy easing has also helped. Europe’s valuation discount has compressed lately – but there’s still a wide gap with the US. The forward price/earnings ratio of the MSCI eurozone index re-rated to 14.5x from 13x in H1, taking it above its 10-year average. And the German index now trades at a near-20% premium to its 10-year average PE, on strength in its aerospace and industrials sectors. That’s more than the S&P 500, with Sweden close behind. |

Year-on-year 2025 eurozone profit growth expectations have fallen to 4% on tariff and currency risk, but it looks set to rise to 11.5% in 2026. Despite the H1 rally, some equity analysts see pockets of exceptional value in wider Europe to keep investors happy.

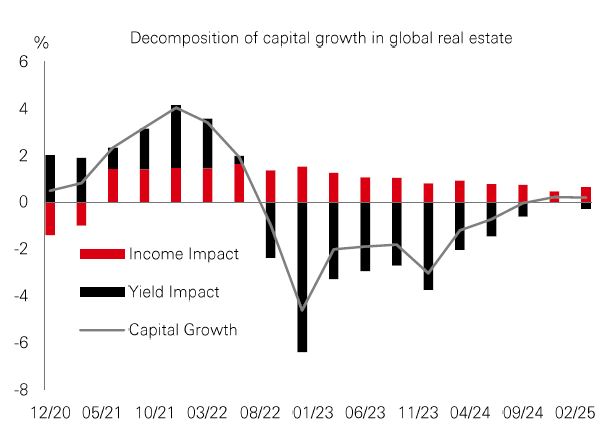

After a challenging period marked by higher financing costs and policy uncertainty, fundamentals in direct real estate are stabilising and liquidity is improving. Capital values are expected to edge upward in the next 12-months, driven by income-led growth, instead of property yield compression. But this recovery may not be uniform across sectors. Retail is one to watch. Long overlooked, it’s re-emerging as a strong performer. Vacancy rates are near historic lows in markets like the US and Tokyo, and rents are rising on the back of a healthier, more resilient tenant base. Yields also remain attractive compared to other sectors. |

Looking ahead, senior housing and data centres may also continue to lead the charge in non-traditional segments. Powered by AI, cloud infrastructure, and demographic tailwinds, these areas show sustained rental growth and rising demand. With alternative asset classes playing a key role as portfolio diversifiers, some specialists believe that with careful consideration and a long-term view, investors can find opportunities in a real estate market entering a more balance and income-driven phase.

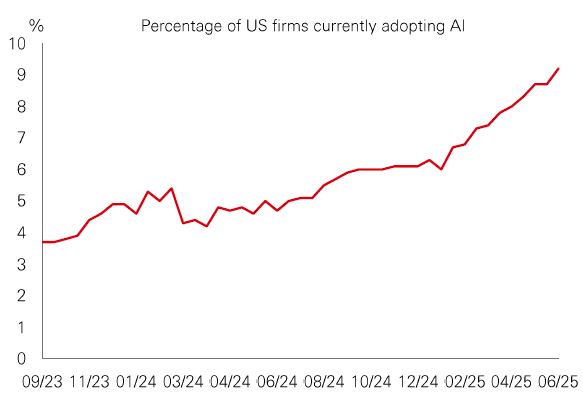

Investor focus has been centred on downside risks this year. But it is important to remember upside risks too. One obvious channel is an AI-led productivity rebound. Almost 9.2% of US firms now use AI, almost double last year’s rate, with financial, IT, and educational sectors leading the charge. Academic studies suggest AI can lift labour productivity by 25% on average. Longer-term, this could have significant upside implications for aggregate output, consumption, investment, and R&D. Of course, the pace and breadth of these gains hinges on how quickly firms adapt, how AI diffuses across sectors, and how issues like data privacy and outdated tech stacks are tackled. |

For markets, increased efficiency could drive corporate profits higher for firms leveraging AI effectively, resulting in upside for equity prices. Meanwhile, bond yields could also see upward pressure amid higher growth that raises demand for capital and pushes r* (the neutral rate) higher. But like all big technological leaps, it won’t be straightforward. Some job losses are likely, while inflation could drop on faster supply growth. Expect this issue to add to uncertainty in the coming years.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 27 June 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 27 June 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Easing geopolitical tensions boosted risk markets, with oil prices declining markedly, and the US dollar continued its recent downtrend against major currencies. US Treasury yields fell amid growing Fed rate cut expectations, driven by some dovish remarks from Fed officials and soft macro data, while rising fiscal concerns weighed on German Bunds. Global equities rose, as robust gains in US tech sector propelled the S&P 500 and Nasdaq Composite close to their all-time highs. In Europe, the Euro Stoxx 50 index was on course to post modest gains. In Asia, equity markets saw broad-based advances, led by Japan’s Nikkei 225, with Chinese equities also rallying. In Latin America, Brazil’s Bovespa index traded sideways while Mexico’s IPC closed higher.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.