23 February 2026

Investors often visualise a clock when thinking about how the evolving economic cycle influences equity market behaviour. The metaphor reminds us that the early hours of the economic recovery mean that it’s time to pivot to deep cyclicals, such as Consumer Discretionary and small caps. As the day continues, and once the rhythm of growth and inflation is more firmly established, the “investment clock” points to later stage cyclicals, including Energy and Industrials. And as it finally comes to a close, and forecasters fret about macro slowdown and recession, the clock selects Consumer Staples, Utilities and Healthcare. Even when GDP disappoints, you still have to clean your teeth.

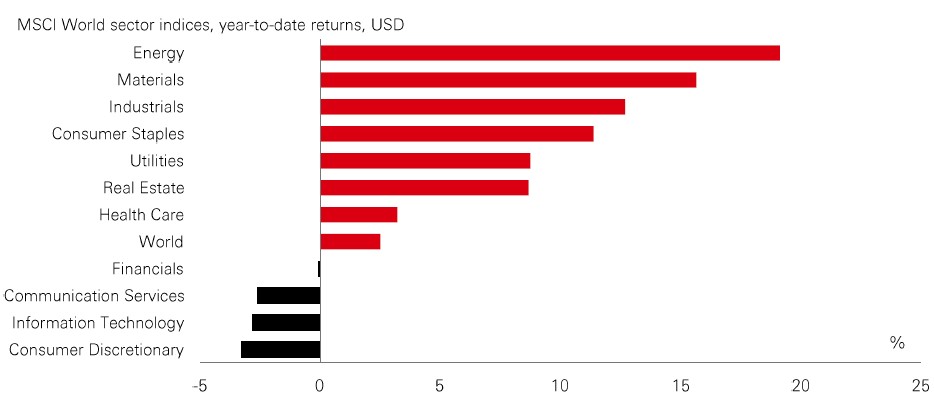

But the investment clock seems to have gone haywire. Like some jet-lagged business executive, it can’t work out what time zone it is in. In 2026 so far, Energy (+19%) and Materials (+16%) are the sector leaders, with Industrials not too far behind. But defensive bets in Consumer Staples (+11%) and Utilities (+9%) are also performing strongly. And price action in small-cap stocks (+9%) confuses things even more. The signal seems to be that we are simultaneously in the early, mid, and late cycle! Good news for the two (or three) handed economists but a confusing picture for the rest of us.

What’s going on? The failure of the clock metaphor sums up the complexity of investment markets today. The system is being buffeted by two key megatrends. Technology is a positive demand shock, and – eventually – a positive supply shock too, but it is also a disruptive force for many businesses and workers. Meanwhile, the changing global order and a new, multipolar world are largely negative supply shocks, but boost some sectors (European defence, for example). Then there is the market rotation story – value is performing strongly versus momentum so far this year, while high-dividend payers are attracting more attention. No one said it was easy. But the complexity serves as a reminder of the importance of a well-researched investment philosophy, and process.

The market’s long love affair with “jam tomorrow” growth stocks is cooling. While the headline indices hold firm, a distinct rotation is under way beneath the surface: a pivot away from tech profits towards value and high-dividend names. After three years in which momentum reigned supreme, investors are waking up to the reality that US hyperscalers may not carry the index forever.

Part of the story is a rotation into infrastructure: not just traditional utilities and transport, but the data centres and energy grids required to power the digital transition. The sector currently trades at a price-earnings ratio of 17x and is at its widest discount to the rest of the market for nearly 10 years. Meanwhile, it boasts a dividend yield of 4.1%, which is more than double the index average. Infrastructure also tends to have a degree of inflation protection and traditionally stable income growth. That reinforces its potential appeal not just as a value play, but as a relatively defensive asset class that benefits from stable cash flows, below average volatility, and low correlations with other asset classes.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg, Macrobond. Data as at 7.30am UK time 20 February 2026.

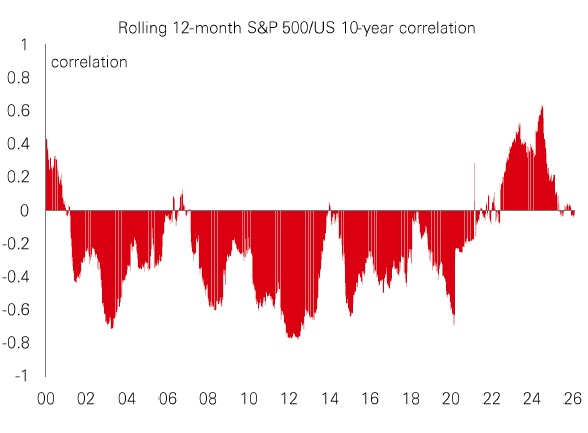

US Treasury market action has been confusing of late. Economic data are surprising to the upside, which would usually be expected to weigh on bonds. However, 10-year yields have dipped by around 0.20% this month, leaving them towards the bottom of their 12-month range. The catalyst isn't found in January’s payrolls print, which points to a labour market that may be stabilising. Rather, recent market distress appears to be a primary driver of bond moves. With the US tech trade faltering, crypto slipping, and gold and silver losing their lustre simultaneously, investors are returning to traditional havens. |

For the 60/40 investor, this is a welcome return to orthodoxy: after a long hiatus, Treasuries are working as a portfolio shock absorber again – for now. But with tariffs keeping goods prices frothy and the colossal AI capex binge posing upside inflation risks, a negative correlation between stocks and bonds isn’t guaranteed. The spectre of fiscal dominance also looms large, with the debt burden and weight of Treasury supply this year. So, while bonds have offered some shelter from the risk-off storm in the last couple of weeks, there’s still a need for other diversifiers in resilient portfolios.

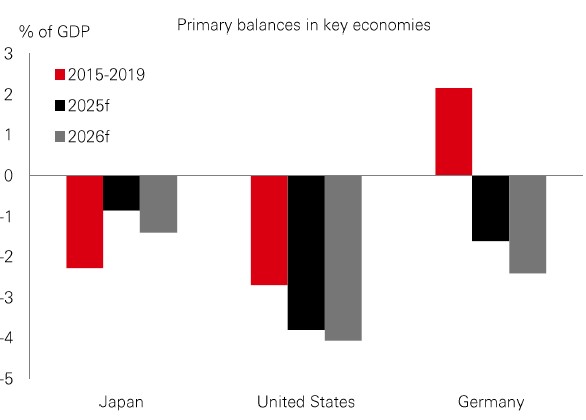

For years, Germany’s “Schwarze Null” policy of sticking to a balanced budget was central to the country’s fiscal policy. Its long-standing commitment to constraint has traditionally shaped its economic debate, positioning it as a global benchmark for good financial behaviour. Yet, in a major shift this year, Germany is pulling the fiscal lever to boost growth. Other economies doing the same have risked unsettling investors. In the US, for example, Treasury yields remain elevated as the market grapples with worries over fiscal easing, geopolitics, and Fed independence. While in Japan, signs of fiscal expansion and a repricing of the inflation regime have pushed bond yields to multi-decade highs. |

But German Bunds could be the exception. With new spending earmarked for defence, infrastructure, and green energy, gross Bund issuance is set to hit an all-time high in 2026. But given its history of prudence and relatively low debt pile, Germany's fiscal path is seen as credible and by far the least concerning in the G7.

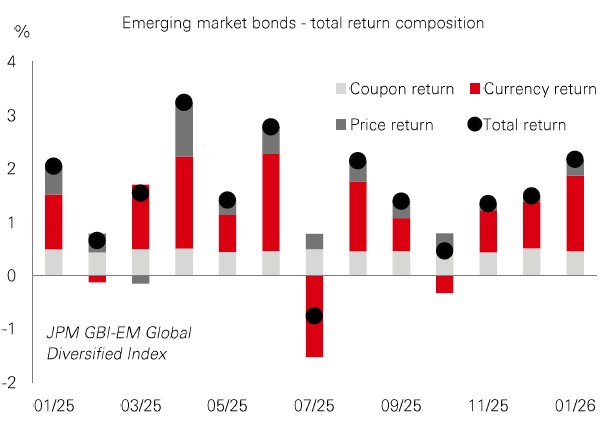

With attractive valuations and improving macro stability, EMs continue to stand out as a destination for global capital. They’re an example of how shifts from lucky to good can pay off for both markets and snowboarders alike.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Costs may vary with fluctuations in the exchange rate. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 20 February 2026.

Source: HSBC Asset Management. Data as at 7.30am UK time 20 February 2026. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

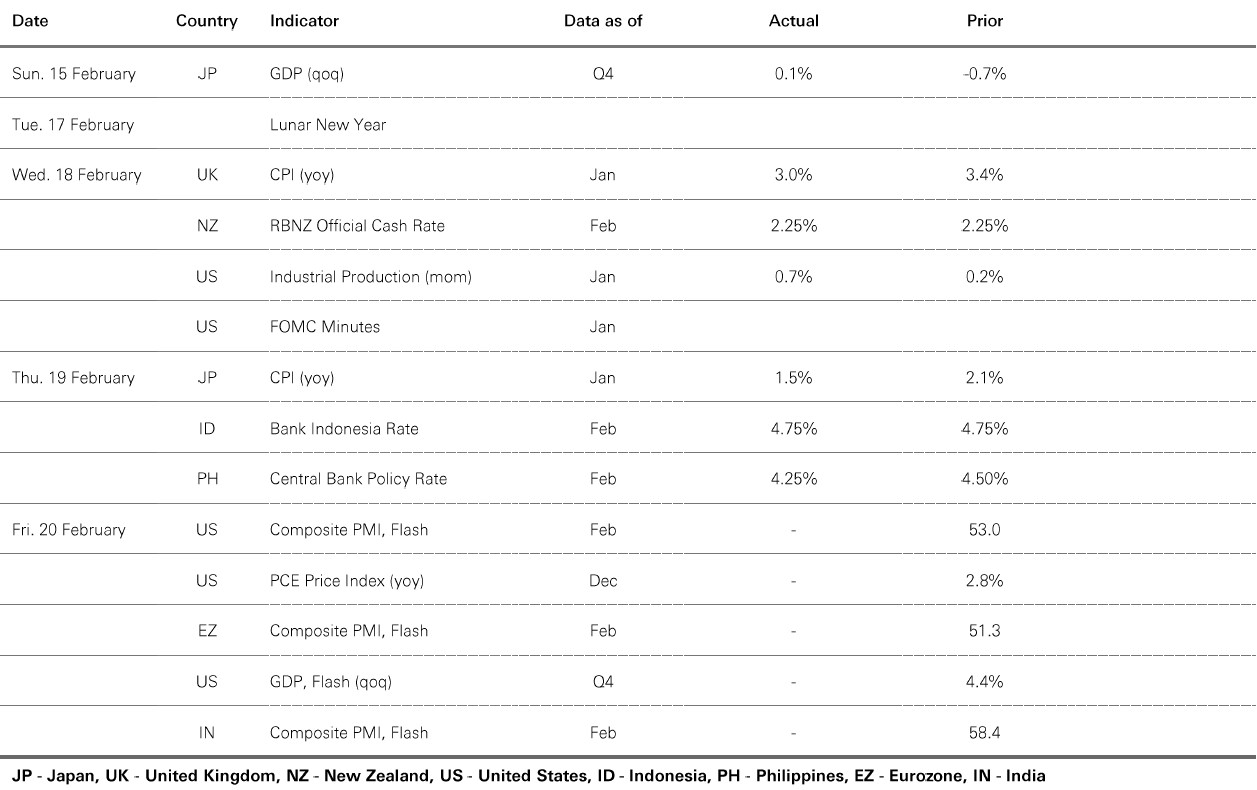

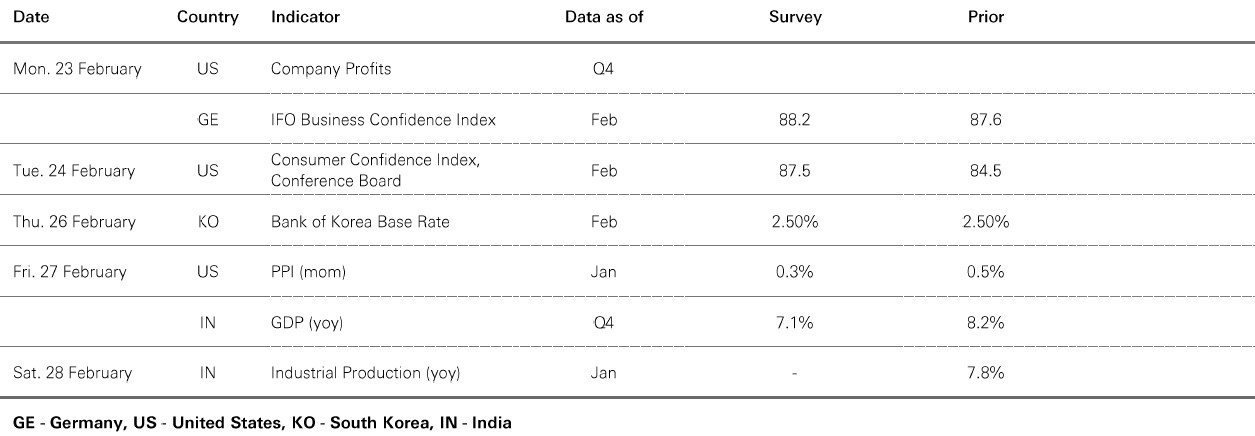

Global equity markets were stable in a holiday-shortened week. In Europe, both the Euro Stoxx 50 and the UK FTSE 100 reached record highs. In the US, while the S&P 500 was set to close the week modestly higher, sector rotation remained a key theme, with investors continuing to shift out of relatively expensive tech stocks into cyclicals such as industrials and materials. In Japan, the Nikkei 225 consolidated following recent gains. EM Asian markets were largely closed for the Lunar New Year holiday, although the tech-driven Kospi index continued to see robust gains. Elsewhere, LatAm stocks traded mixed. January’s FOMC minutes revealed that some members viewed maintaining current policy “for some time” as appropriate. The US dollar broadly rose against major currencies, and 10-year US Treasuries were range-bound. In commodities, oil prices rose on geopolitical concerns.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.