27 February 2026

US stocks fell on Thursday, led by losses in tech shares. The S&P 500 fell 0.5%, while the tech-heavy Nasdaq lost 1.2%.

US Treasuries rose amid stock market weakness. 10-year yields fell 5bp to 4.00%.

European stocks mostly rose on Thursday. While the Euro Stoxx 50 was down 0.2%, the German DAX rose 0.4% and the French CAC gained 0.7%. In the UK, the FTSE 100 ended 0.4% higher.

European government bonds rose. 10-year German bund yields fell 2bp to 2.69%, while 10-year French bond yields edged down 1bp to 3.25%. In the UK, 10-year gilt yields fell 5bp to 4.27%.

Asian stock markets traded mixed on Thursday. Japan’s Nikkei 225 gained 0.3% while Korea’s Kospi surged 3.7%. Meanwhile, India’s Sensex and China’s Shanghai Composite ended little changed, as Hong Kong’s Hang Seng fell 1.4%.

Crude oil prices ended modestly lower on Thursday. WTI crude for April delivery settled 0.3% lower at USD65.2 a barrel.

The Bank of Korea kept its policy rate unchanged at 2.50%, as expected. The central bank upgraded its growth and inflation forecasts while signalling a largely neutral policy stance in the coming six months.

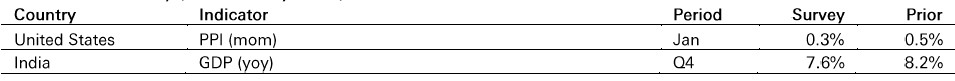

In the US, PPI is expected to have risen 0.3% mom in January compared to a 0.5% mom gain in December. The lagged impact of higher tariffs could lift final-demand core goods PPI, while services PPI has been volatile.

India’s real GDP growth should remain robust at 7.6% yoy in the October-December 2025 quarter, after rising 8.2% yoy in the July-September quarter. A new GDP series with the fiscal year 2022-23 as its new base will be released.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.